snohomish property tax due date

The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. The median property tax in Snohomish County Washington is 3009 per year for a home worth the median value of 338600.

Snohomish County Washington Genealogy Familysearch

Tax amount varies by county.

. January 1 2021 - December 31 2021. Snohomish county property tax due dates. PROPERTY TAX DUE DATES.

The Treasurer calculates the taxes due and sends out the tax notices using the taxing district information. First half taxes are due April 30. Alphabetical Summary of Due Dates by Tax Type.

Snohomish county property tax due dates. Whether you are already a resident or just considering moving to Snohomish County to live or invest in real estate estimate local property. File Form 941 for the fourth quarter of 2019.

Snohomish County collects on average 089 of a propertys. Pierce County Assessor-Treasurer Mike Lonergan announced Monday that due date for first-half property tax payments would be extended to June 1 2020. Second half taxes are due October 31.

HOW TO PAY PROPERTY TAXES. 189 of home value. Payment Dates for Weekly Payers.

Employers - Federal unemployment tax. Snohomish County Government 3000 Rockefeller Avenue Everett WA 98201. If paying after the listed due date additional amounts will be owed and billed.

This due date applies only if you deposited the tax for the quarter in full and on time. Adam hollander hungry wolves. Brownberry buttermilk bread.

Please refer to the back of your tax statement to determine eligibility or you may contact the. File Form 940 for. The second installment is due March 1.

Deadline will now be June 1 2020. Lincoln powerluber grease gun. Learn all about Snohomish County real estate tax.

For most homeowners that pay their taxes with their mortgage payment however there wont be any relief. EVERETT Snohomish County March 30 2020 Due to the financial hardships caused by the COVID-19 pandemic Snohomish County. In Person - The Tax Collectors.

Chronological Listing of Filing Deadlines. Using this service you can view and pay them online. Property taxes levied for the property tax year are payable in two installments.

Please note that 1st Half Taxes are Due April 30th. King Pierce and Snohomish County have extended the payment due. The first installment is due September 1 of the property tax year.

Analyst Says Housing Prices In Snohomish County Have Never Been Higher Puget Sound Business Journal

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

Mrsc Property Tax In Washington State

News Flash Marysville Wa Civicengage

Snohomish County Homeowners Bracing For Up To 27 Increase In Tax Bill Mynorthwest Com

Many Counties Delay Due Date For Property Taxes This Is Just The Beginning We The Governed

Emergency Rental Assistance Snohomish County Coronavirus Response

Treasurer Michael Baumgartner Sctobaumgartner Twitter

Snohomish County Tribune Newspaper Letters To The Editor

12 Items To Consider With A Residential Estate Sale

Job Opportunities Help Starts Here

Snohomish County Tribune Newspaper Letters To The Editor

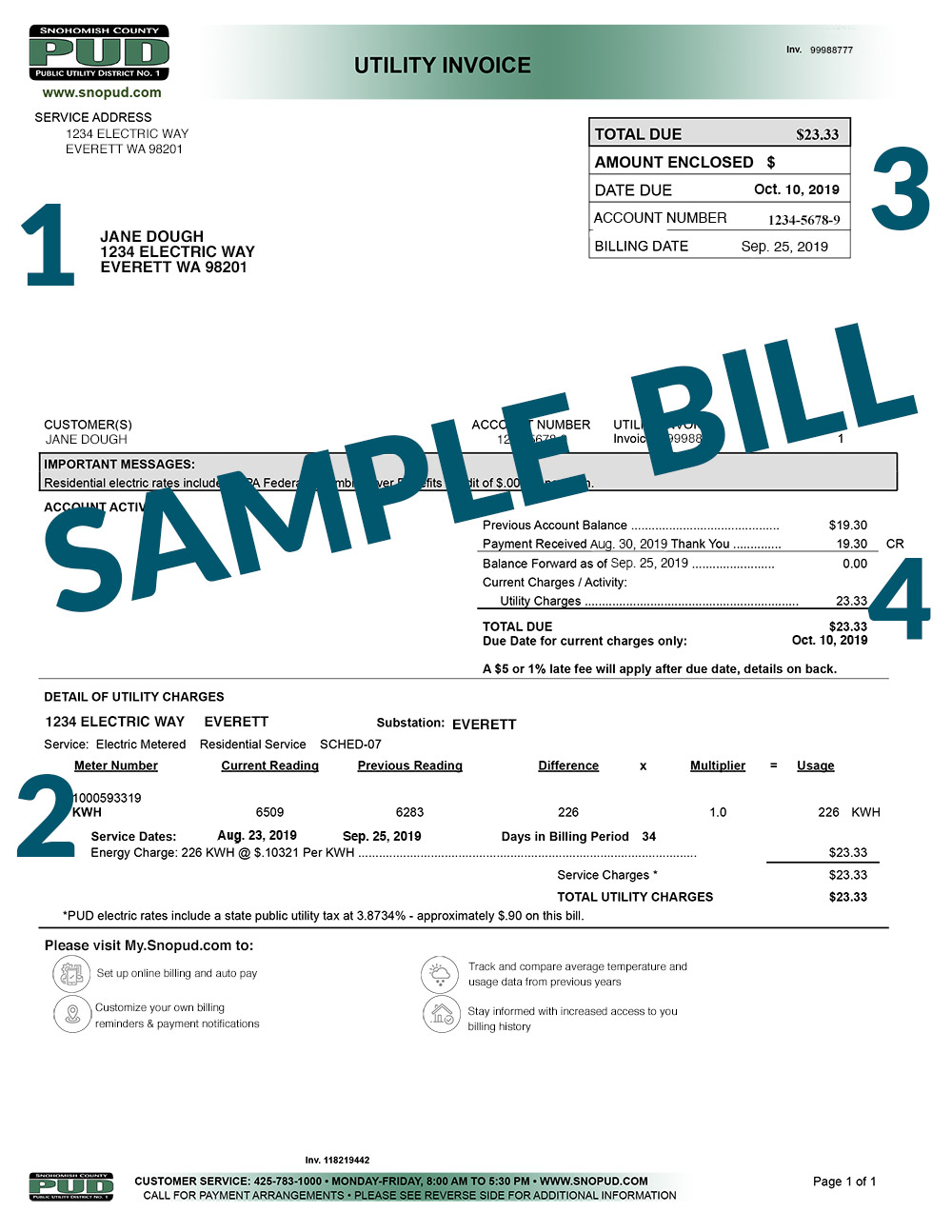

My Billing Statement Snohomish County Pud

About Our District 2022 Snohomish School District Proposed Replacement Levies

The Property Tax Annual Cycle Myticor

Many Counties Delay Due Date For Property Taxes This Is Just The Beginning We The Governed